When market volatility rises, our clients count on CreditSights to help navigate through the uncertainty. Time and time again, our teams have done the hard work to provide our clients with our analysis when there is a lack of information in the market, relying on our experience in and knowledge of credit markets.

During March 2023, we all witnessed how a potentially isolated regional bank crisis caused ripples around the world and raised broader concerns about the global banking sector. This fear then spilled into credit and equity markets, impacting most sectors. Starting with an analysis of SVB, then regional and money center banks, our team looked for the next stresses across sectors and published to our audience with the latest facts, breaking news, and research. Our clients have direct access to our team, allowing in-depth conversations that surface additional insights.

Recent Event Coverage

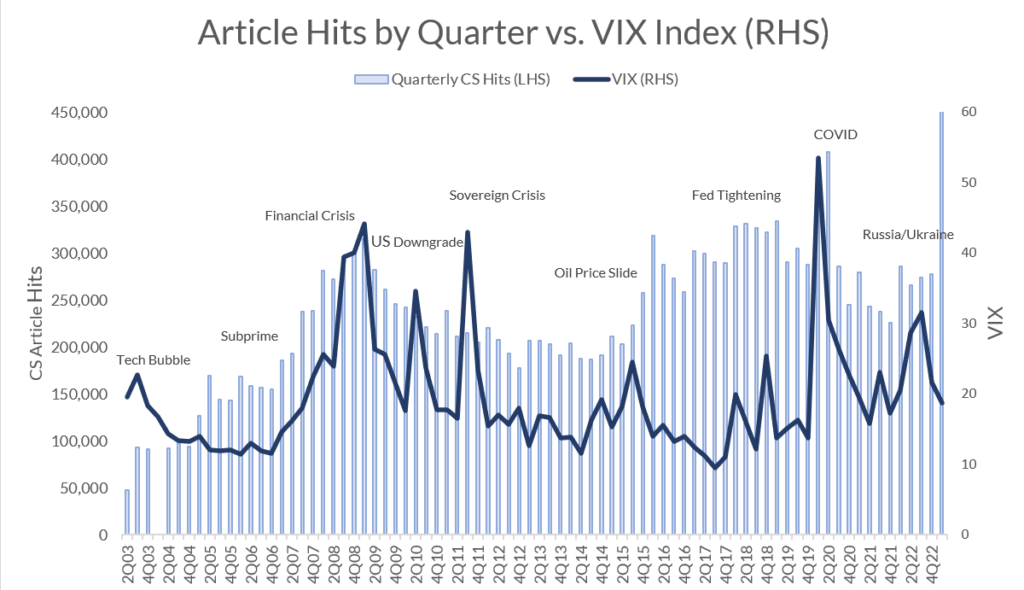

As the chart above shows, our clients rely on our team’s work when the markets become less certain. Additionally, we have also recorded webinars and run Q&A sessions to respond quickly to a large volume of questions from our customers.

If you missed any of these events organized by CreditSights, check out our platform => “Events” to see all our recorded content. This will take you to our upcoming event calendar, as well as links to past events. Non-customers can also view some of these resources online. Here are some of our recent postings::

|

|

|

| Global Market Update for April 2023 | Bank Liquidity versus Data Dependency | Silicon Valley Bank Q&A Webinar |

| Winnie and Zachary Griffiths, Senior Strategist, discussed our 2Q23 Outlook for the U.S. and European corporate credit markets, as well as Updated expectations for the Fed and ECB in light of the recent banking sector fallout. | Our strategy team discussed the events in early March, including the collapse of Silicon Valley Bank, volatility in corporate credit markets, the February CPI print and how these events were likely to influence the Fed’s decision-making process at its upcoming March meeting. | Head of US Financials, Jesse Rosenthal, Senior Financials Analyst, Peter Simon, and Senior Special Situations Analyst, Joshua Kramer, hosted a Q&A webinar to discuss the collapse of SVB, answering all the critical questions that our clients are asking.. |

Not a CreditSights.com Subscriber?

Get ahead of the next crisis cycle. Take a look at the combined offerings of CreditSights, Covenant Review and LevFin Insights on our new platform. You will find a full spectrum of credit insights to help you make informed investment and risk decisions.

If you’re interested in our latest analysis on the SVB collapse and concerns about the regional banks and other related sectors, we encourage you to request a trial, just complete this form and we’ll get back to you.